Book - Cash Flow Quadrant¶

Metadata¶

- Author:

- Full Title:

- Category:

- Link:

- ISBN:

Notes¶

The Cashflow Quadrant Explained – How You Earn Income Matters¶

By Chad Carson 33 Comments Filed Under: Entrepreneurship & Business, Financial Independence & Early Retirement

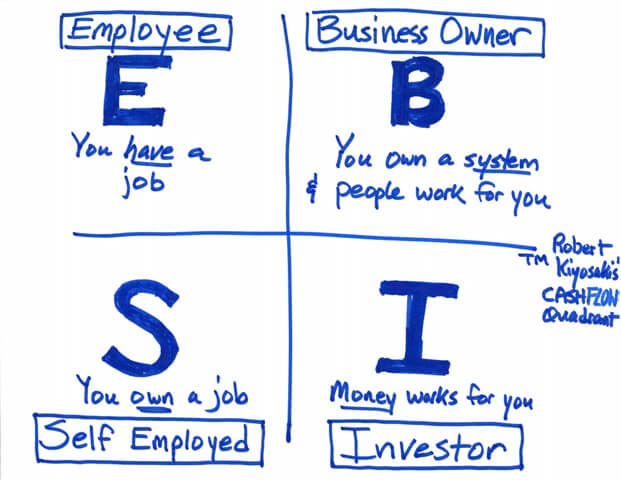

The CASHFLOW Quadrant represents the different methods by which income or money is generated … Different methods of income generation require different technical skills, different educational paths, and different types of people.”

Robert Kiyosaki, Cashflow Quadrant

The Cashflow Quadrant. It’s the main idea of Robert Kiyosaki’s book by the same name. And it’s a powerful one that has guided much of my own entrepreneurial path to seek financial freedom.

As you can see, each quadrant represents a different way to generate income. Some people earn money in only one quadrant, while some people earn money in all four. There are advantages and disadvantages to each.

But the two quadrants on the right side (B & I) are the primary paths to financial freedom. The majority of Kiyosaki’s book teaches the unique skills and mindsets required to succeed on this path.

Let me explain a little more about each of the four quadrants:

E – Employee¶

An employee has a job. This is where most people earn their income. The job itself is owned by a business, which could be a single person or a large corporation. The employee gives his or her time, energy, and skills to an employer in exchange for a pay check and benefits.

Employees can make a little or lot of money. But when an employee stops working (or when the business stops), their income stops, too.

This long-term lack of control over income is the primary problem of the E quadrant. An employee’s financial destiny, security, and freedom is dependent upon the whim and the success of their employer.

S – Self-Employed¶

Many employees get tired of their lack of control and choose to work for themselves. The self-employed still work, but they own their job.

The S quadrant includes dentists, insurance agents, restaurant owners, realtors, handymen, and many other trade workers. Many self-employed people earn very large incomes, but like the employee, when they stop working so does their income.

Self-employed people do have a lot more control than an employee, but that also means they have more responsibility. As a result, success usually means working harder and working longer. Over the long run this can lead to burn out and fatigue.

B – Business Owner¶

Those in the B quadrant own a system and lead people. The systems and people who work for the business can run successfully without the business owner’s constant involvement.

The same types of businesses could be run by S owners and B owners. For example, a plumber could own and work in his own plumbing business, or a business owner could create a plumbing business and hire quality plumbers, administrators, and a manager to run the systems of the plumbing business.

The wealthiest individuals in the world typically own businesses. These include Bill Gates of Microsoft, Jeff Bezos of Amazon, and Mark Zuckerberg of Facebook.

I – Investors¶

Investors own assets that produce income. This is the quadrant for truly passive income.

Investors in this quadrant have usually accumulated money earned in one or more of the other three quadrants, and they let the money go to work and produce even more money for themselves.

Investors often purchase shares of companies owned by those in the B quadrant. The capital from the investors helps to fuel the systems created by the business owner, and this fuel can lead to even greater growth (and more income) for everyone involved.

There are multiple paths to financial independence, but most of them ultimately lead to the right side of the quadrant – B and I. So, if you want to achieve greater financial independence and freedom, it will pay to start learning the skills and mindset required to make this move to the right side.

Which quadrant represents you? Where do you earn most of your income? What about your spouse? Your friends? Which part of the cash flow quadrant would you like to move to first? I’d love to hear from you in the comments section below.¶

Created : 21 septembre 2023